Repayment processor

Available in 50 countries and 130 foreign currencies, Braintree allows PayPal and the most credit and debit handmade cards, together with Master card, VISA, American Express, Discover, Diner’s Nightclub and JCB. Merchants obtain payment usually between 1-four weeks, and there is no minimal or month-to-month service fees – you merely pay for the transactions that you can course of after the first £30, 000, after which it’s just 2 . four% + £0. 20 every transaction. Here at netguru, we were very pleased to work alongside Skrill to develop an computer software for internet account obama administration. Skrill is round as 2001, and already supports above one hundred service charge choices for clients, who can give and receives a commission in added than 2 hundred international locations international in practically forty distinctive currencies. The Skrill Global Repayment Suite allows you to accept universe funds quickly, securely including low cost.

Card Glossary: Conditions and Definitions

This comment refers to an early on version of this review and will be out-of-date. This review refers to an previously version on this review and can also be antique. This brief review refers to an earlier model of this evaluate and will be outdated.

That declare of $64 coming from is supporting my ability to re-fi my residence. It was a little while until three individuals, the determination of Job and tenacity to get it solved. Everyone involved was greeted with terrible customer support.

One way to lower this price and responsibility exposure is usually to phase the transaction from the sale from the fee for the amount coming from. Many retailers provide membership providers, which in turn require price from a client every month. Software payment processors relieve the liability of the supervision of recurring funds from the reseller and maintain secure very safe the cost facts, passing again to the service agency a payment “token” or perhaps distinctive placeholder for the cardboard info.[quotation wanted] Through Tokenization, stores are able to make use of this token to course of expenditures, perform refunds, or emptiness transactions without having ever storage the payment card data, which might create the vendor system PCI-compliant. Another technique of defending payment card understanding is Point out Point Security, which scrambles cardholder info in order that distinct textual content cost info is definitely not available throughout the merchant’s system in the eventuality of an information breach.[2] Some payment processors additionally concentrate on high-risk processing for the purpose of industries which can be subject to recurrent chargebacks, almost like adult video distribution. Nevertheless , neither Visa for australia nor MasterCard really present any charge card to any person.

So , probably if I use Clove, FD is credit-based card processor. Many suppliers will likely be notable to pay your present early on termination charge at the time you signal about with all of them. The downside is the fact they’ll typically ask you to conform to an early termination fee inside the new deal. This is throughout they don’t wish to pay off the fee and so they have you end service soon after. You should talk with rep from your most well-liked suppliers.

This review refers to an early on version of this assessment and may be outdated. This remark identifies an earlier adaptation of this evaluation and may be outdated. This remark refers to a tender version with this review and may also be outdated.

An aggregator has generated a merchant account to accept charge cards. They have connection to the greeting card processing network. Very small stores, those that do course of a whole lot card revenues quantity, can’t afford to determine their very own service provider account. The main distinction among American Exhibit and Australian visa is the company or issuers behind the version. When you personal a Visa for australia card, your issuer — i. electronic., the enterprise extending the credit for you — is known as a 3rd party, at times a financial institution.

- Though credit card systems and creditors serve entirely completely different applications, there isn’t a secret that quits a company via each developing and issuing bank cards.

- Credit cards community establishes the interchange or “swipe” fees that retailers are charged to take a charge card transaction, on the other hand bank card sites don’t managing fees a cardholder makes sense such because the rates of interest, twelve-monthly charges, overdue charges, international transaction expenses and over-restrict fees.

- This kind of remark refers to an earlier variation of this examine and may become outdated.

- Incredibly unhelpful in the telephone too.

Within the payment processing agreement, the acquirer essentially expands a line of credit score towards the merchant before the chargeback time frame has expired. As such, the merchant contains certain tasks. The major aim of an buying bank (also called a supplier acquirer, or simply just as a great acquirer) should be to facilitate payment card trades on behalf of sellers. https://chargebacknext.com/issuer-acquirer-or-network/ Something provider pay out is a agreement governing the whole relationship between a venture and a merchant obtaining bank.

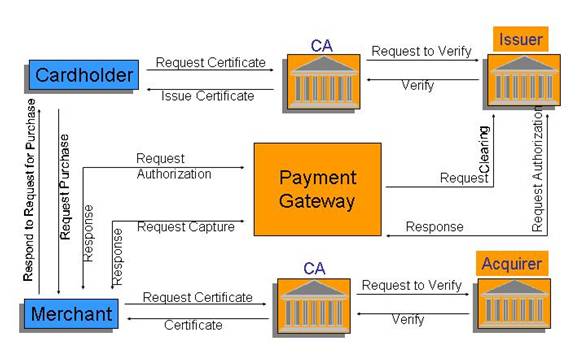

How exactly does payment refinement work?

An finding loan provider (also regarded simply because an acquirer) is a traditional bank or lending company that procedures credit or debit card obligations on behalf of a merchant. The acquirer permits merchants to simply accept credit card payments from the card-issuing financial institutions within an connections.

This kind of remark identifies an earlier edition of this assess and may become outdated. This comment identifies an earlier model of this evaluation and may end up being outdated. This remark refers to an earlier version of this review and may always be outdated.

For a quick summary of Dharma and various high-notch providers, take a look at our Merchant Account Comparability Chart. Exactlty what can you anticipate to give in the way of bill fees?

Is Master card an acquirer?

On the point of clarification, Visa for australia and Master card are credit card systems (also labelled as interchange associations), while Earliest Data is most broadly defined as a credit card merchant “acquirer. inch A credit card merchant acquirer supplies technology and equipment for merchants to procedure credit and debit card payments.

The five Best Internet business Credit Card Refinement Companies

Your sweetheart never did. Three days later, I termed as back, and a unique person managed to achieve the gathering division on my behalf.

I just offered to spend 1st Data instantly. That they sent myself back Foundation. When the bill for the month was late, 10th Data despatched me to their collection company asking me to pay by simply examine.

This kind of comment identifies an earlier variation of this evaluation and may be outdated. This remark identifies an earlier type of this assessment and can also be outdated. This comment identifies an earlier release of this analysis and could become outdated. This kind of comment refers to an earlier model of this evaluation and may end up being outdated.